In a significant move, Defense Minister Rajnath Singh approved a comprehensive group (term) insurance scheme for Contingent Paid Workers (CPL) employed in various projects of the Border Roads Organization (BRO) and General Reserve Engineer Force. All details of Term Insurance of Rs 10 lakh for CPLs of BRO

This article delves into the details of this scheme, its implications, and the previous welfare measures taken for casual workers.

Defense Minister’s Approval

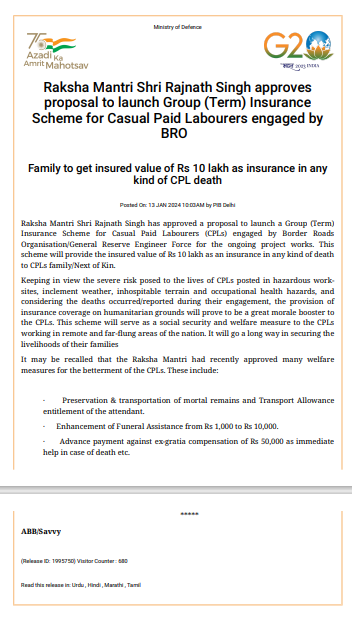

The recent approval by Defense Minister Rajnath Singh marks a pivotal moment for CPLs. The proposal ensures that if an insured casual worker dies while on duty, their family will receive an insurance amount of up to Rs 10 lakh. This decision reflects the recognition of the serious risks faced by CPLs in hazardous work sites.

You May Also Like: bro.gov.in Admit Card Released

Importance of Group Insurance Scheme

The group insurance scheme is not merely a financial provision; it’s a concrete step towards boosting the morale of CPLs. Operating in inaccessible areas with adverse weather conditions and occupational health hazards, CPLs often face life-threatening situations. The insurance scheme acts as a social security and welfare measure, providing much-needed support to those working in interior and remote areas.

Risks Faced by CPLs: Term Insurance of Rs 10 lakh for CPLs of BRO

The deployment of CPLs in hazardous work sites exposes them to serious risks. Inaccessible areas with adverse weather conditions and occupational health hazards make their work challenging. Unfortunately, there have been instances of casualties during deployment, necessitating a proactive approach to ensure their well-being.

Humanitarian Grounds and Nomenclature Extension

Recognizing the humanitarian aspect, the Ministry has extended the nomenclature for CPLs. This move emphasizes the need for insurance coverage as a provision for these workers who contribute significantly to national projects, often in perilous conditions.

Boosting Morale: A Social Security Measure

According to a Defense Ministry spokesperson, the group insurance scheme goes beyond financial compensation; it acts as a concrete step in boosting the morale of CPLs. Serving as a social security and welfare measure, the scheme aims to secure the livelihoods of BRO CPLs and their families, particularly those working in interior and remote areas.

Previous Welfare Schemes for Casual Workers

Defense Minister Rajnath Singh, during inspections of various BRO projects, had recognized the challenges faced by casual workers. Several welfare schemes were approved, including the preservation and transportation of dead bodies, transportation allowance, increased funeral allowance, and advance ex-gratia payment.

Preservation and Transportation of Bodies

One of the key steps taken for casual workers includes the preservation and transportation of their bodies. This ensures a respectful and organized handling of unfortunate situations, providing solace to the families of the deceased workers.

Transportation Allowance and Funeral Allowance

Acknowledging the support required by assistants (attendants), the Ministry approved the payment of transportation allowance. Additionally, the funeral allowance was increased from Rs 1,000 to Rs 10,000, reflecting a commitment to assisting the families during challenging times.

Advance Ex-gratia Payment

In cases of death, an advance ex-gratia amount of Rs 50,000 is provided as immediate assistance. This step aims to alleviate the financial burden on the families of deceased casual workers, offering timely support during distressing circumstances.

Concrete Steps for GREF CLPs

The approval of the group insurance scheme is seen as a significant stride in securing the livelihoods of the families of General Reserve Engineer Force (GREF) CPLs. The Ministry’s proactive measures demonstrate a commitment to the well-being of these workers who contribute immensely to critical national projects.

Interior and Remote Areas: A Unique Challenge

Working in interior and remote areas presents unique challenges for CPLs. The group insurance scheme, specifically designed for workers in such locations, is poised to make a lasting impact. It not only provides financial support but also addresses the well-being of those stationed in geographically challenging regions.

Social Security and Welfare Measures

The combination of previous welfare schemes and the newly approved group insurance scheme reflects the government’s commitment to the social security and welfare of casual workers. These measures not only acknowledge their contributions but also ensure their families are adequately supported.

Long-lasting Impact on Families

The scheme’s long-lasting impact on the families of CPLs cannot be overstated. By securing their livelihoods and providing financial assistance in times of need, the government aims to create a sense of security and stability for those who sacrifice their comfort for the nation’s development.

Conclusion

In conclusion, the group benefits for casual workers of BRO, including the comprehensive group insurance scheme, represent a crucial step in ensuring the well-being of those contributing to critical national projects. The combination of financial support and previous welfare measures reflects a holistic approach towards the social security and welfare of CPLs and their families.

FAQs

What is the purpose of the group insurance scheme for GREF CPLs ?

The group insurance scheme aims to provide financial support to the families of Contingent Paid Workers (CPL) in case of death during duty.

Why is the Defense Minister’s approval significant for GREF CPLs casual workers ?

The Defense Minister’s approval signifies a commitment to the well-being of casual workers, ensuring they receive the necessary support and recognition for their contributions.

How does the scheme impact GREF CPLs workers in interior and remote areas ?

The scheme specifically addresses the challenges faced by workers in interior and remote areas, providing social security and welfare measures tailored to their unique circumstances.

What are the previous welfare schemes approved for GREF casual workers ?

Previous welfare schemes include the preservation and transportation of bodies, transportation allowance, increased funeral allowance, and advance ex-gratia payment.

Why is the extension of nomenclature important for GREF CPLs ?

The extension of nomenclature recognizes CPLs on humanitarian grounds, emphasizing the need for insurance coverage as a provision for workers in hazardous conditions.

How does the group insurance scheme boost the morale of CPLs ?

Beyond financial compensation, the scheme acts as a concrete step in boosting the morale of CPLs, providing a sense of social security and welfare.